Publisher Take-Two Interactive has today reported its financial results for fiscal Q3 2020, and it’s a mixed bag. Overall, the numbers are slightly down year-on-year and less than its previous forecast, and the publisher has also reduced its forecast for next quarter. Still, Q3 was fairly decent considering it is being measured against a year in which Red Dead Redemption 2 launched.

Further, the past three months have highlighted the exceptional continued performance of its portfolio post-launch, supported by recurrent consumer-spending.

Chairman and CEO of Take-Two Strauss Zelnick said of today’s results:

“Throughout the 2019 holiday season, we experienced robust demand for our offerings that drove third quarter operating results solidly within our increased outlook.

Highlights included the performance of Grand Theft Auto Online and Grand Theft Auto V, NBA 2K20, Red Dead Redemption 2 and Red Dead Online, The Outer Worlds and Borderlands 3, reflecting our ability to deliver some of the most captivating experiences in the entertainment industry. Fiscal 2020 is shaping up to be another terrific year for Take-Two.”

Key takeaways from the report include: “GAAP net revenue at $930.1 million, as compared to $1.249 billion in last year’s fiscal third quarter. Recurrent consumer spending (which is generated from ongoing consumer engagement and includes virtual currency, add-on content and in-game purchases) increased 15% and accounted for 37% of total GAAP net revenue.”

2K cites several games as the largest contributors to net revenue, including NBA 2K20/19, Grand Theft Auto, Red Dead Redemption 2, The Outer Worlds, Borderlands 3, WWE 2K20, and more.

Elsewhere: “Digitally-delivered GAAP net revenue increased to $700.3 million, as compared to $594.7 million in last year’s fiscal third quarter, and accounted for 75% of total GAAP net revenue.”

Also: “GAAP net income was $163.6 million, or $1.43 per diluted share, as compared to $179.9 million, or $1.57 per diluted share, for the comparable period last year.”

Finally: “During the nine-month period ended December 31, 2019, GAAP net cash provided by operating activities increased to $440.0 million, as compared to $390.2 million in the same period last year.

During the nine-month period ended December 31, 2019, Adjusted Unrestricted Operating Cash Flow (Non-GAAP), which is defined as GAAP net cash from operating activities, adjusted for changes in restricted cash, was $547.9 million, as compared to $587.0 million in the same period last year. As of December 31, 2019, the Company had cash and short-term investments of $1.984 billion.”

As for net bookings, Take-Two highlights: “During fiscal third quarter 2020, total Net Bookings were $888.2 million, as compared to $1.569 billion during last year’s fiscal third quarter, which had benefited from the launch of Red Dead Redemption 2. Net Bookings from recurrent consumer spending grew 6% and accounted for 41% of total Net Bookings.

Catalog accounted for $359.7 million of Net Bookings led by Grand Theft Auto, Red Dead Redemption, and Social Point’s mobile offerings.

Digitally-delivered Net Bookings were $690.6 million, as compared to $703.8 million in last year’s fiscal third quarter, and accounted for 78% of total Net Bookings.”

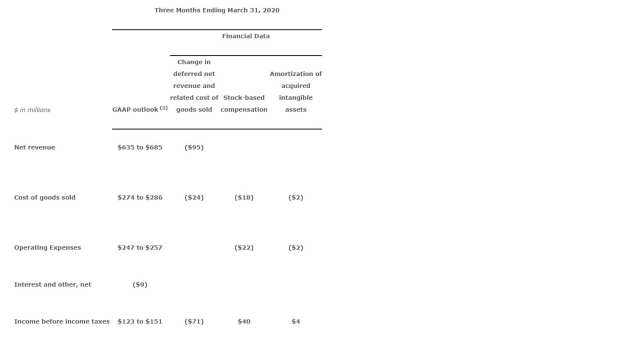

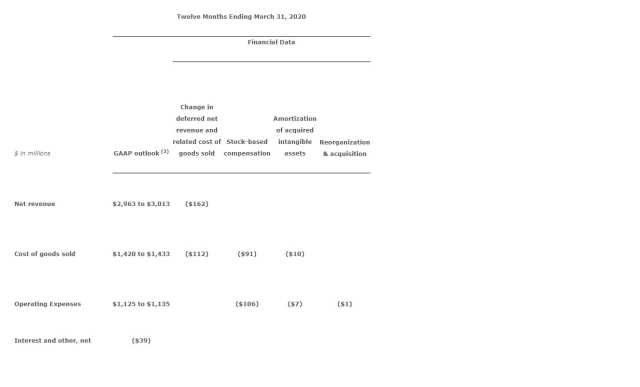

Images of financial data can be viewed below.

Outlook for Fiscal 2020

Take-Two is providing its initial outlook for its fiscal fourth-quarter ending March 31, 2020 and is adjusting its outlook for the fiscal year ending March 31, 2020:

Fourth Quarter Ending March 31, 2020

- GAAP net revenue is expected to range from $635 to $685 million

- GAAP net income is expected to range from $105 to $128 million

- GAAP diluted net income per share is expected to range from $0.92 to $1.12

- Share count used to calculate both GAAP and management reporting diluted net income per share is expected to be 114.6 million (1)

- Net Bookings (operational metric) are expected to range from $540 to $590 million

The Company is also providing selected data and its management reporting tax rate of 17%, which are used internally by its management and Board of Directors to adjust the Company’s GAAP financial outlook in order to facilitate comparison of its operating performance between periods and to better understand its core business and future outlook:

You can check out a breakdown of the financial data here.