Today Activision released its financial results or the second quarter of 2019. Since the publisher goes by calendar years instead of the usual fiscal year, this means the period between April 1 and June 30.

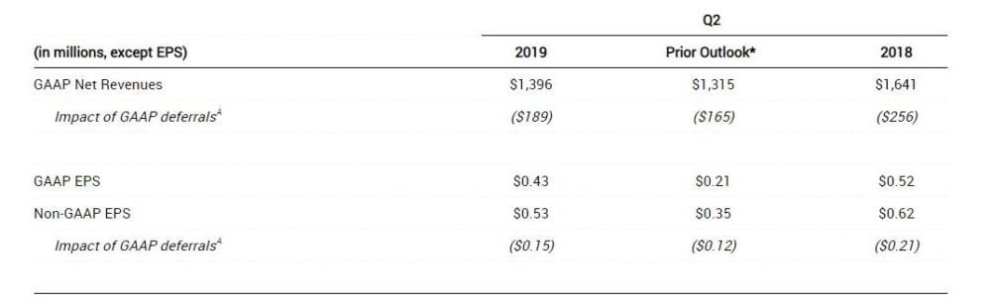

Below you can see a table summarizing the relevant figures.

According to the press release, the results exceeded the company’s expectations.

We also get a comment by Activision Blizzard Chief Executive Officer Bobby Kotick.

“Our second quarter results exceeded our prior outlook for both revenue and earnings per share. In the first half of 2019 we have prioritized investments in our key franchises and, beginning in the second half of this year our audiences will have a chance to see and experience the initial results of these efforts.”

The press reease included a series of business highlights, which you can read below.

Audience Reach

- Activision Blizzard had 327 million Monthly Active Users (MAUs) in the quarter.

- King had 258 million MAUs. Candy Crush franchise MAUs grew year-over-year, driven by growth in Candy Crush Saga and the addition of Candy Crush Friends Saga.

- Activision had 37 million MAUs. Call of Duty: Black Ops 4 MAUs grew year-over-year versus Call of Duty: WWII, and hours played increased by more than 50%. Crash Team Racing: Nitro-Fueled enjoyed positive critical reviews and strong sales, particularly through digital channels.

- Blizzard had 32 million MAUs. Hearthstone MAUs grew quarter-over-quarter following the release of the Rise of Shadows expansion and The Dalaran Heist single-player Adventure. Overwatch MAUs were relatively stable quarter-over-quarter, with engagement increasing following the release of the Workshop. Subscribers in World of Warcraft® increased since mid-May, following the release date announcement and beta for World of WarcraftClassic and the Rise of Azshara content update.

Deep Engagement

- Total time spent in King’s Candy Crush franchise grew strongly year-over-year.

- Total hours played inActivision’s Call of Duty franchise rose double-digits year-over-year.

- Daily time spent per player in Blizzard’s franchises again increased year-over-year.

- Overwatch League hours viewed continued to grow robustly year-over-year in the two stages held during the second quarter. Season-to-date, viewership and average minute audience have grown double-digits year-over-year.

Player Investment

- Activision Blizzard delivered approximately $800 million of in-game net bookings in the second quarter.

- King’s Candy Crush was the top-grossing franchise in the U.S. mobile app stores, a lead position it has held for the last two years1.

- Advertising in the King network continued to ramp, with net bookings growing sequentially and doubling year-over-year.

- For Call of Duty: Black Ops 4, net bookings from in-game items grew year-over-year versus Call of Duty:WWII and are ahead of WWII on a comparable life-to-date basis.

- Hearthstone net bookings grew sequentially in Q2 following the release of Rise of Shadows and the introduction of the paid single-player Adventure, with the expansion also outperforming last Q4’s Rastakhan’s Rumble.

If you want to compare, you can check out the results for the previous quarter, which were published in May.

Updated: Aug 8, 2019 04:27 pm