XRDC released its fourth annual AR/VR Innovation market report this week, reviewing the current state and future growth potential of the augmented, virtual, and mixed reality markets based on survey responses from over 900 developers working with the technologies. The report precedes the company’s annual conference show, which is running from Oct. 14-15 this year.

The data highlights some interesting takeaways that spell good news for the AR/VR/MR scene but also plenty of hurdles that developers remain concerned about.

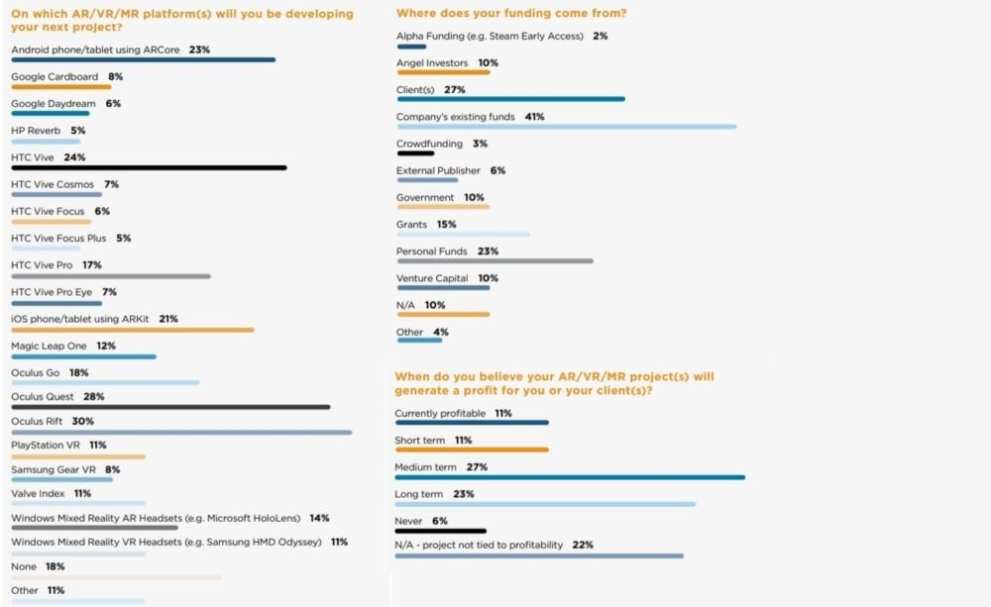

Notably, this year saw a huge increase in the number of developers working on Oculus products, which saw the Quest and Rift platforms overtake HTC Vive as the platform go-to for the first time. Quest comprised 30%, while Rift accounted for 28%. 24% of respondents are developing for Vive, while only 7% are working on PSVR games.

While developers are still concerned about comfort, battery life, and the complexity of VR setups limiting market growth prospects, the accessibility of the Quest platform seems to be a beacon of hope in this regard.

One respondent said:

“I think the biggest hurdle to VR has been long setup times with cubes, computer configurations, and so on,” wrote in one survey-taker. “There have been recent advances in this area though that address those concerns. Headsets like the Quest hit all the checkboxes to make

widespread VR deployment realistic.”

Another said that “the Quest’s market penetration” had them most excited, because “if this is successful enough it will jumpstart the market,

even though the content isn’t very mature.”

Another big positive for the market was the increase in client investment and a decrease in developers using their own personal finance to fund VR/AR projects. This suggests the market is maturing and that clients are seeing potential in “well-made VR products.”

Unfortunately, developers still aren’t seeing much in the way of short-term returns. In fact, short term profit was down year-on-year, though the report notes this could be explained by hobbyists and not-for-profits entering the market.

Still, responses like the following aren’t all that positive when it comes to market size and funding for small to medium-sized companies:

- “Funding is plentiful, but most of the money gets swallowed up by the largest corporations. Unfortunately, small and medium-sized companies are growing by acquisition into larger companies rather than solo development.”

- “Small and medium companies shoulder such a large amount of the risks to bring a product to market. It would be great to have

some capital or resources to bring visibility to these smaller projects before they are selling off company assets.” - “There is a gap between the cost of production and the expected budget for mixed reality projects,” wrote another. “There still needs to be a large push to support projects that reduce the costs of development so that more content can be created.”

You can read plenty of other interesting commentary and view full data sets by downloading the report yourself for free. To keep yourself up to speed with the release dates for upcoming VR games, don’t miss our monthly guide.

Updated: Aug 6, 2019 03:31 pm